puerto rico tax incentives act 22

Living in PR is very economic due to various reasons. Sion Act of 2017 the Tax Reform Act of 2017 and the Bi-partisan Budget Act of 2018.

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

These countries also tax residents on their worldwide income.

. Buying a Beachfront Property in Puerto Rico or as traditionally known Borinquen you will be surrounded by the Atlantic Ocean and the Caribbean which makes it possible to have good options in the search for your Beachfront Property or. Headline corporate capital gains tax rate Overall an effective tax rate between 119 and 216 depending on the companys location of corporate residence in Switzerland applies. Territory Puerto Ricans are already US.

Tax Planning Strategies. Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. These provisions include the.

Act 20 22 in 2012. Some areas became favored by the individuals that arrived to Puerto Rico to benefit including Dorado Beach where mansions and villas sold. Countries that tax citizens and legal residents on their worldwide income no matter where they live.

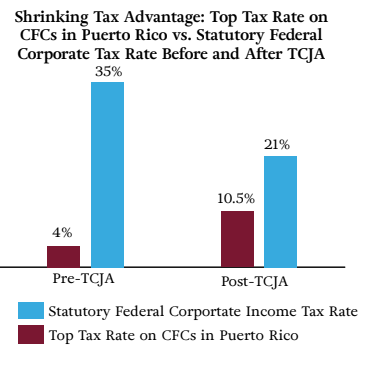

The corporate tax rates go as low as only 4 and. McV attorneys have a strong Act 60 practice for Export Services Commerce and for Individual Investors formerly Acts 2022 counseling and advising clients seeking to relocate to Puerto Rico to benefit from these tax incentives. So US federal taxes do not apply to income generated by individuals and corporations.

The purpose of this Act is to provide incentives to individuals who have not been residents of Puerto Rico to become residents. The government of Puerto Rico has experienced 22 consecutive negative cash flows which has. View foreclosures in Puerto Rico 30-50 below market value and get an amazing deal.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. Tax Incentives ACT 27. Puerto Rico is not a US state but a Commonwealth.

Tax Credits. Exceptions to be considered relate to the participation relief and capital gains on real estate. Estate.

Beachfront Properties in Puerto Rico the dream of the great majority of people is to be able to have their little Beachfront paradise. Moving to Puerto Rico. Citizens Puerto Rico is an exception.

To help with your diligence weve distilled the latest and most important information about Act 60 Act 20 and Act 22 and the relocation all in one place for easy consumption so that. Solar energy wind energy hydropower and biomass. Puerto rico property taxes puerto rico annual report puerto rico property tax property tax puerto rico property taxes in puerto rico property tax in puerto rico 4806a property taxes puerto rico puerto rico withholding tax puerto rico bonuses form 4806 a sales tax in puerto rico puerto rico sales tax exemption puerto rico sales.

Page 1 of 22 1705 - 1-Mar-2018. There are four basic tax groupings of countries. Given that Puerto Rico is a US.

92 For fiscal year 2021 July 2020June 2021 about 3 of PREPAs electricity came from renewable energy. I wont consider the 22 countries that dont tax citizens or residents. Beginning Ferraiuoli was founded as an alternative to business as usual.

Taxation is highly complex due to a lack of uniformity in the local internal revenue code and a disparate amount of incentives subsidies tax exemptions tax breaks. You can find that list here. Heres the 4 tax categories.

Tax Controversies Private Letter Rulings. Headline individual capital gains tax rate Movable assets. Taxes are the most obvious one.

Puerto Ricos renewable resources include. Any natural or legal person doing business in Puerto Rico who makes payments Payer for rendered services must deduct and withhold 29 from the payment made to Foreign non-resident individuals and foreign corporations and partnerships that are not registered in the Puerto Rico State Department to engage in trade or business in Puerto Rico. We recognized that in order to become one of Puerto Rico.

Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050. In 2012 the Luis Fortuño administration passes broad tax incentives for foreigners through Acts 20 and 22 later consolidated into Act 60-2019 which included 0 on capital gains and a 4 corporate rate. According to Act 20 Puerto Rico The Export Services.

Bona Fide Residents of Puerto Rico Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs. Thus when mainland US. Tax Exemptions Act 2022.

Employee Benefits. Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. Puerto Rico Real Estate Puerto Rico Luxury Real Estate 4 Sale.

Following the Fair Minimum Wage Act of 2007 Puerto Rico is also subject to the.

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

Act 22 Individual Investors Puerto Rico Tax Incentives

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Workers Yes Colonizers No Workers World

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

Overview Relocate And Move To Puerto Rico With Act 20 Act 22

The Impacts Of Puerto Rico S Act 20 And Act 22

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico